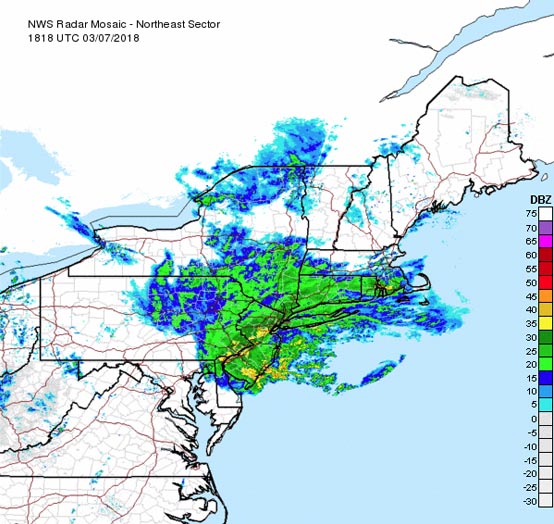

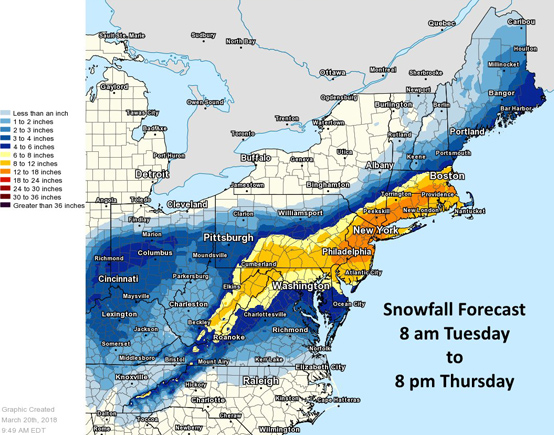

Port of NY/NJ Closing Due to Another Winter Storm

Another significant winter storm is expected to hit New York, New Jersey, and Newark beginning this evening and continuing into Thursday, 3/22. As a result, the port of New York & New Jersey has closed all marine terminals for 3/21. We expect most facilities to announce similar closures for Wednesday. Depending on the nature of…

Read More »