FTZ Savings Calculator Updated

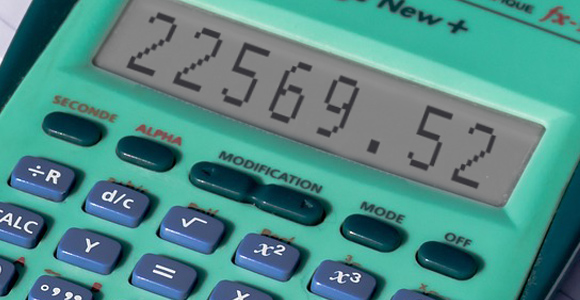

You might have heard about Foreign Trade Zones (FTZ) and that your company could save a substantial amount of money by operating within one, but is it worth it? Estimate what these savings might be with our FTZ Savings Calculator, which has been updated to reflect the new maximum Merchandise Processing Fee (MPF) of $497.99.…

Read More »